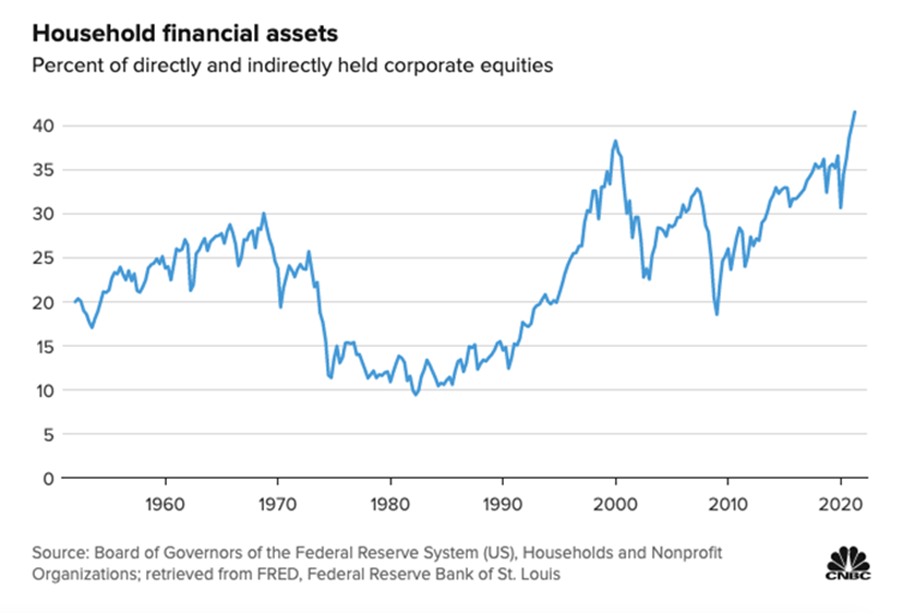

About half of the $109.2 trillion of household financial wealth is made up of stock market holdings, and that equity share of assets hasn’t been this high in 70 years, reports an article in CNBC. Household net worth leapt to $141.7 trillion in the 2nd quarter of 2021, driven by a $3.5 trillion rise in corporate equities’ value.

This is obviously good news for stock-holding individual investors, but also raises worries about taking risks if the market’s good fortune changes. According to Mitchell Goldberg, president of ClientFirst Strategy, people tend to put their wealth into stocks and houses, and both are tied to interest rates, which are currently at a record low. Alongside the Fed pouring money into the market, and an abundance of policies pushing the value of these assets up, the question becomes what will happen when those policies disappear.

While Fed officials have suggested they’ll begin slowing the pace of their monthly asset purchases by the end of this year, analysts don’t believe that they’ll start raising interest rates until late 2022 or the beginning of 2023, according to those quoted in the article. Though some executives have grown cautious in the current environment, it hasn’t stopped investors from flooding the market, to the tune of $34.5 billion in U.S. equity mutual funds and ETFs this year alone. Still, Goldberg is advising his clients—especially his older ones—to scale back their holdings a bit and start building up cash in preparation for a potentially challenging and volatile environment.