By Jack Forehand, CFA (@practicalquant)

I never write about politics. I certainly have political opinions, just like everyone else. I have a series of views about how I think the world should work. And I feel very strongly about some of those things.

So why don’t I ever write about them? I don’t do it for two reasons.

Subscribe to the Excess Returns Podcast: YouTube | Apple

First, I don’t think the audience who reads my articles cares about my political opinions. And that is the way it should be. I am certainly not a political expert (although I may have convinced myself otherwise) and I write for an investing blog. My job is to try to write about things that I have learned that have made me a better investor over the years. My views on the current political climate just don’t pass that test.

The second reason I don’t write about politics is the more important one. As strongly as I feel about my political beliefs, I have learned over the years that even if everything I think should happen politically were to magically become reality, it isn’t likely to have much of an impact on the long-term returns of the stock market.

If there is one investing lesson all of us should keep in mind as our world becomes more and more polarized every day and we work through what might be the most tumultuous election any of us have seen in our lifetimes, I think that is it.

If you are a Republican, you may feel like a world where the principles you believe in are the ones that guide our policy is a better one. If you are a Democrat, you likely believe that a completely different series of policies will make the world a better place. I can understand both of those views because I feel the same way about my own political beliefs.

But what we all need to recognize is that which party is in power is not predictive of what the market will do.

Which Party Does the Market Perform Better Under?

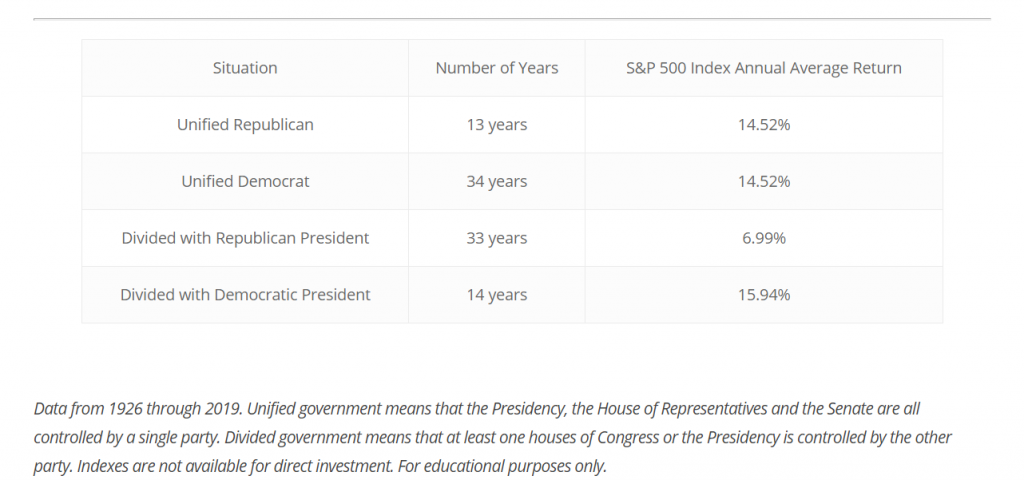

Although most investors likely think that the markets do better during Republican administrations due to their pro-business policies, the long-term data actually shows the opposite to be true. The S&P 500 has actually produced a greater annual return during Democratic administrations. But I wouldn’t read anything into that.

When you dig into the details, which this chart from McClean Asset Management does, you will see that the returns under unified Republican and Democratic governments are identical. The big difference has been that the market has performed much better with Democratic presidents in divided government scenarios than it has under the same situation with Republican presidents.

source: https://www.mcleanam.com/are-republicans-or-democrats-better-for-the-stock-market/

The Role of Luck and Timing

But I think the bigger reason that it is very difficult to use the party that controls the presidency to predict stock returns is that much of the return of the stock market during any administration is determined by factors outside its control.

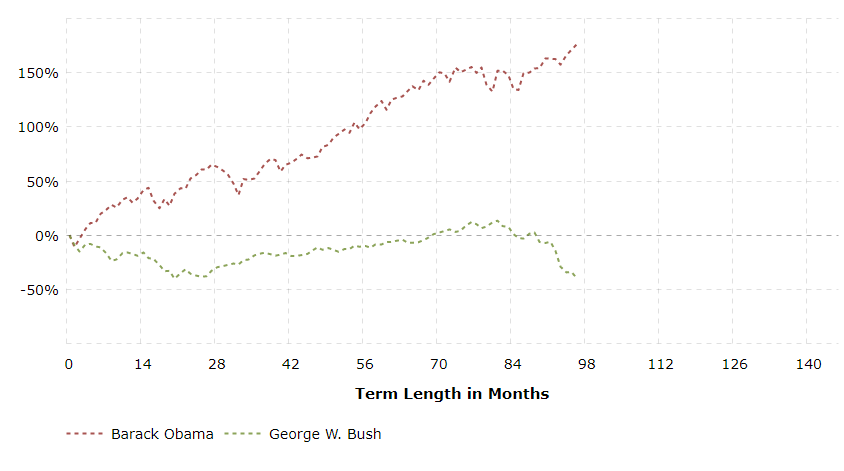

For example, Barack Obama came into office very close to the market low after the 2008 bear market. That is likely a recipe for above average returns during an administration no matter which party is in control. George W. Bush entered the White in early 2001, right in the middle of the 2000-2002 bear market and left the presidency after the massive losses in the Fall of 2008. So Bush’s time as President was bookended by two major bear markets.. The chart below highlights just how different the market performance was under these two presidents. This is not in any way meant as an evaluation of their policies. It is more an acknowledgement that like many outcomes in investing, luck and timing can play a major role. Across time and history presidents have faced many other exogenous events, including wars and even pandemics like we are dealing with now. These types of outside events can lead to wide variation in the returns under different administrations that have little to do with their policies.

Source: S&P 500 Performance by President

Economic policy changes can also take time to work their way through the system. So it is very possible that an administration can enact policies that are great for the market, but have the benefits of those policies occur during the term of its successor. And the reverse is true too. Some administrations have implemented terrible economic policies and stuck their successors with the resulting problems.

Finally, it is also important to acknowledge that although my chart above contains 80 years of data, it includes 16 different presidents. From a statistical standpoint, an “n” (number of observations) of 16 is very low. This means we can’t really draw any statistically significant conclusions from the data regardless of what it shows.

The Changing Tide of Policy

Another important thing to keep in mind right now is that the difference between the two sides when it comes to the market may be less than you think. Although the policies that a Biden and Trump administration may pursue will likely have very different impacts on your average person, their impact on the overall market may not be that different. The reason is that both candidates are embracing increased use of fiscal stimulus and are showing less concern about the implications of debt than has been the case in the past. Although a Republican administration will likely mean lower taxes, a Democratic one will likely mean more stimulus. We are also likely to see more aggressive trade policies and more focus on making the country more economically independent in both cases, especially in the wake of the Coronavirus. I don’t say that to endorse any particular policy. I say that because from a pure stock market perspective, the differences in the policies of both parties may not be as great as you think.

The Battle Between What I Believe and How I Invest

There is a lot at stake in this election. Many of us feel much more strongly about the implications of the outcome than we normally would. But no matter how strongly you believe that the world will be a better place if your preferred candidate wins, that doesn’t mean that the stock market will be. And our job as investors in to produce the best long-term returns we can for our portfolios. The ability to separate your political beliefs from your investment strategy is an important part of that. The stock market may go up after election day. It may also decline. But either way, if you look back 30 years from now and look at this election from a purely investment-based perspective, you are likely to see its importance in a very different light. Instead of seeing it as something that played a major role in determining whether you achieved your investing goals, you are likely to see it only as a blip on the radar.

Jack Forehand is Co-Founder and President at Validea Capital. He is also a partner at Validea.com and co-authored “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies”. Jack holds the Chartered Financial Analyst designation from the CFA Institute. Follow him on Twitter at @practicalquant.