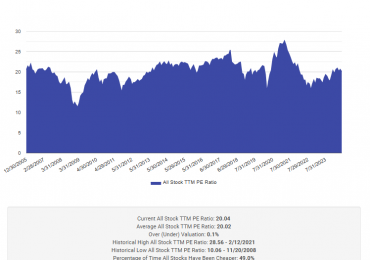

Yale professor and Nobel laureate Robert Shiller popularized the cyclically adjusted price-to-earnings ratio, but he’s moved on to a different metric called the excess CAPE yield, contends an article in MarketWatch. This new model considers both equity valuation and interest-rate yields. While the former index is often used to show that stocks are overvalued, the latter shows that current valuations aren’t outrageous.

The article quotes Adam Slater, lead economist at Oxford Economics, as saying there’s “a fundamental problem with the low rates argument—we may be comparing one overvalued asset class with another.” There’s been much talk about what could move yields higher, with a likely catalyst being hot inflation readings that last longer than the Federal Reserve expects.

Using Shiller’s new method of valuation measure, if real rates rise to where they were at the end of 2018, that could put us in 2007 territory—just prior to the global financial crisis of 2008.