Constantly reacting to news headlines, writes Mark Hulbert in MarketWatch, will not only prevent an investor from beating the market, it can also precipitate “attacks of doom and gloom.”

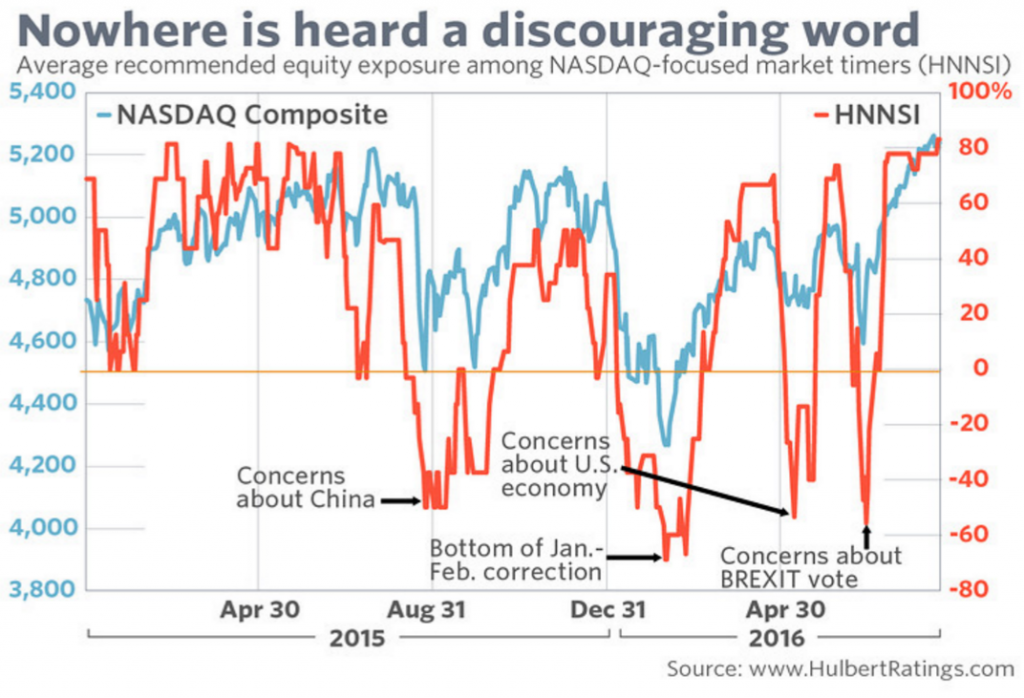

He reminds readers how the crash of China’s stock market in 2015 led to “panic selling in the U.S. equity market. In one five-minute window late in August 2015, the Dow Industrials were down by more than 1,100 points.” Hulbert points out that the panic at that time presented a “great buying opportunity.” He argues, however, that “investors never learn” and that, since that time, the U.S. market has suffered three additional hits of pessimism.

During each of what Hulbert terms the four “spasms of fear”, the average recommended stock market exposure levels dropped precipitously (as measured by the Hulbert NASDAQ Newsletter Sentiment Index, or HNNSI). Unfortunately for the bulls, Hulbert writes, “today is at the opposite end of the spectrum from where it was” with the HNNSI at above 80%.

While the stock market is holding steady at the moment, Hulbert warns that “if history is any guide, we are unlikely to see as explosive a rally in coming weeks as we did following each of those past four occasions in which fear dominated investors’ mood.”

His message is clear: “If the time to buy is when there is blood running in the streets, the time to sell is when there’s dancing. And right now there is a whole lot of dancing.”