By Justin Carbonneau (@jjcarbonneau) —

As we roll into year-end, the prediction business is about to pick up steam. Business channels and investing columns will soon be filled with lists carrying titles like “10 Surprises of 2023”. Predictions and forecasts by humans are often wrong for a host of reasons, but as investors we seek them out and hang on the words of experts who seem smarter than the rest of us. But if 2022 has taught us anything, it should be that few predicted some of the most important trends that influenced markets and investors’ portfolios over the last year. But rather than throw the forecasters under the bus, let’s think about what we can learn from big trends in the market this year.

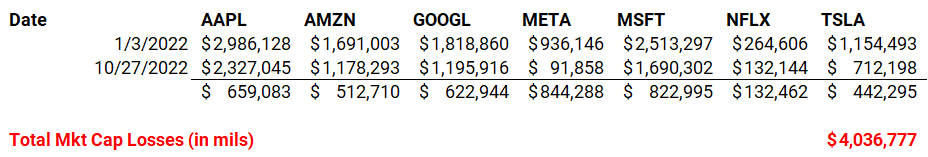

Lesson #1: The Best Aren’t Immune from Declines

At the start of the year the collective market capitalization of Apple, Amazon, Google, Meta (Facebook), Microsoft, Netflix and Tesla were north of $11 trillion dollars. Fast forward to the end of October and the value of those companies had fallen by four trillion, which is roughly the size of the entire value of all companies that trade on the Hong Kong Stock Exchange (helps give some context to the sheer size of the losses). Investors thought these mega cap tech companies would continue to be market leaders and were immune from downturns. And that might be the largest lesson in this one – no stock, no matter how bulletproof it may look, is a sure thing or immune from losses in the short run.

Lesson #2: The Future is Unknowable – Even for PhDs

Remember the term NIRP (negative interest rate policy)? Well you can kiss that goodbye.

After 15 years of mostly falling interest rates, yields took off in early 2022. The chart below shows the U.S. 10 Year Treasury around 1.5% less than a year ago. Today yields are around 4.2%. Top economists, Federal Reserve governors and Wall Street strategists – many with PhDs and decades economics experience and education – didn’t see this coming. If some of the smartest people in finance didn’t see rates and inflation as high as it is today, it goes to show just how difficult is it making macro calls. Great investors like Warren Buffett and Howard Marks have explained for years that macro investing is highly difficult because outcomes are unknowable – 2022 has proven these investors right yet again so investors should probably take macro calls with a grain of salt.

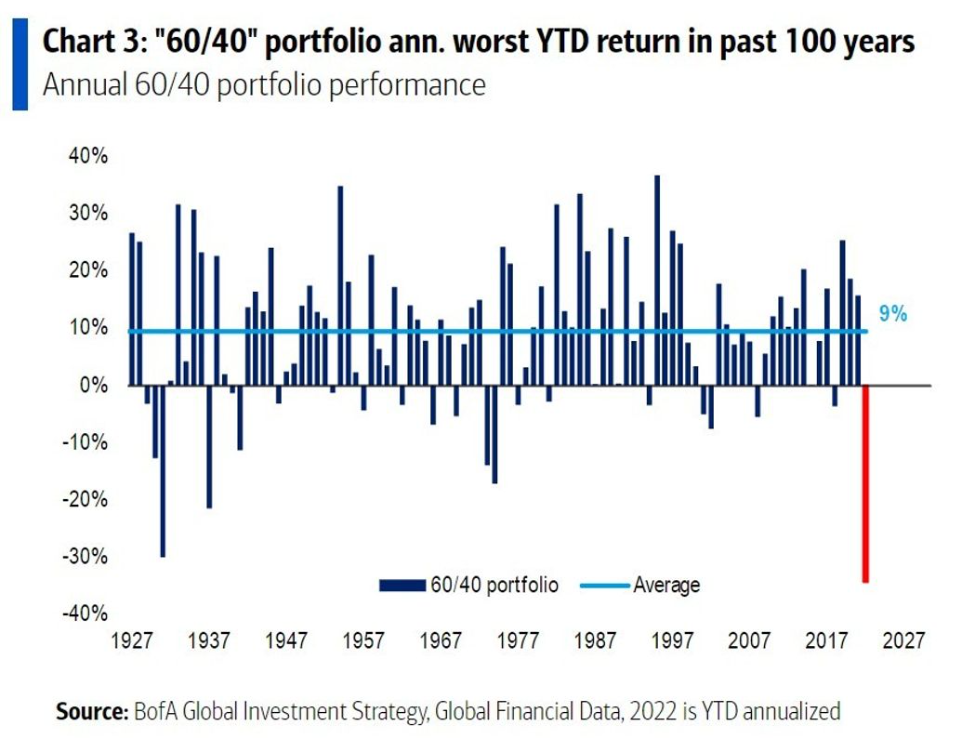

Lesson #3: Thinking Differently About Diversification

Up until 2022, the 60/40 stock-bond portfolio was a stalwart investment strategy. Bonds had been in a 40-year bull market. And stocks, while they suffered in major bear markets, had rewarded long-term holders as well. But at the start of the year, equity valuations were high and yields were historically low. The set up didn’t look good for the 60/40. And the worst-case scenario happened – stocks and bonds fell at the same time. According to a note from Bank of America, the 60/40 is in one of the worst drawdowns in the past 100 years. Mixing stocks and bonds for diversification is typically good, but some investors may consider blending in other assets, or even approaches like trend following, in order to avoid this double whammy in the future.

Lesson #4: Down but Never Really Out

At the end of 2020, the energy sector had fallen to less than a 2% weight in the S&P 500, as investors fled the sector for a number of reasons. But this years rebound in the energy patch has put the sector weighting back up over 4%. The chart below is of the Energy Select Sector SPDR ETF (XLE) – a year ago the ETF was trading around $52/share and as of today it’s around $93/share, more than a 60% upside move that very few investors saw coming. Lesson learned: when a sector or group falls out of favor, investors tend to pile on, but at some point, there is a chance things will come back. By avoiding those areas you lose the chance at periods like this when they mean revert for reasons you could have never predicted.

Balancing the Past, Present & Future

As investors, we are mostly concerned about what the future holds because that is what will impact our portfolios, livelihoods and more. This is why we value predictions, because we believe that those predictions will produce some type of positive or negative outcome that will have a direct effect on us. Current behavior and emotions are largely based on what is happening now, in the present, when recent experiences are influencing us more. The past gets discounted, but should play an equal part in influencing us as we learn from failures and successes. Balancing the past, present and future is likely the best chance for long-term success. There is one thing we can say for sure: 2023 is bound to have good and bad surprises that few will have predicted. But as an investors you will be able to learn and grow from these experiences if you think about in the correct context.