Two years ago, John Rekenthaler posited that cash could be used as a hedge against inflation, citing 3 previous periods in the past (post-WWII, the mid-1960s, and the early 1970s) when it would have worked. Now, in an article for Morningstar, he revisits that theory to test it against today’s record-setting inflation.

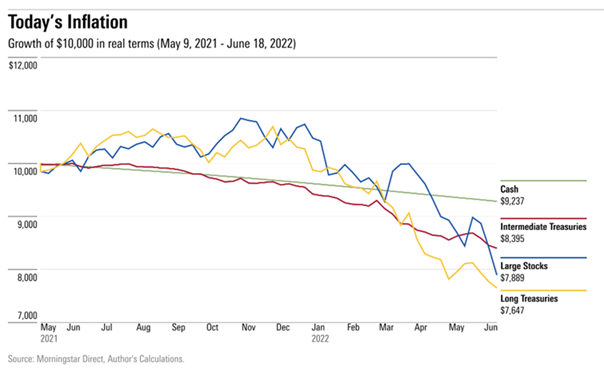

Comparing how stocks, long bonds, intermediate bonds, and cash performed starting from May 12, 2021 (when the BLS first reported inflation) through June 18, 2022, Rekenthaler found that while cash did not produce a positive real return, it still outperformed the other three assets. He then looked at five unconventional assets: TIPS, multi-strategy funds, gold, commodities (mainly energy), and bitcoin. Commodities, especially energy, flourished the most, followed by cash, with TIPS, multi-strategy funds, and gold not far behind. Bitcoin, however, was a dud. The conclusion there, Rekenthaler posits, is that a portfolio allocated between those four alternative assets would likely do better than cash in an inflationary period such as today.

An alternative-heavy portfolio does best when inflation persists, Rekenthaler points out—once inflation subsides, stocks and bonds will come bouncing back, especially if the employment rate stays healthy. Then, alternatives and cash will fall behind stocks and bonds. But if a recession looms, bonds would likely be the safest haven, followed closely by cash, with alternatives and stocks lagging behind. And cash is still an attractive inflation hedge, Rekenthaler maintains, because it’s not in danger of cratering if a recession rears its ugly head. But for those who firmly believe that inflation will persist for some time, alternatives are probably the wiser choice.